The Hidden Costs of

Buying a House in the UK

Buying a property involves more than just the deposit. From legal fees to stamp duty, use our calculator to see exactly how much cash you need to save before applying.

Why this matters:

- • Solicitors and surveyors must be paid upfront.

- • Stamp Duty can add thousands to your bill.

- • Lender product fees are often overlooked.

What Are All These

Hidden Costs?

Conveyancing (Legal) Fees

You pay a solicitor to handle the legal transfer of ownership. This includes checking boundaries, handling the money, and registering the title.

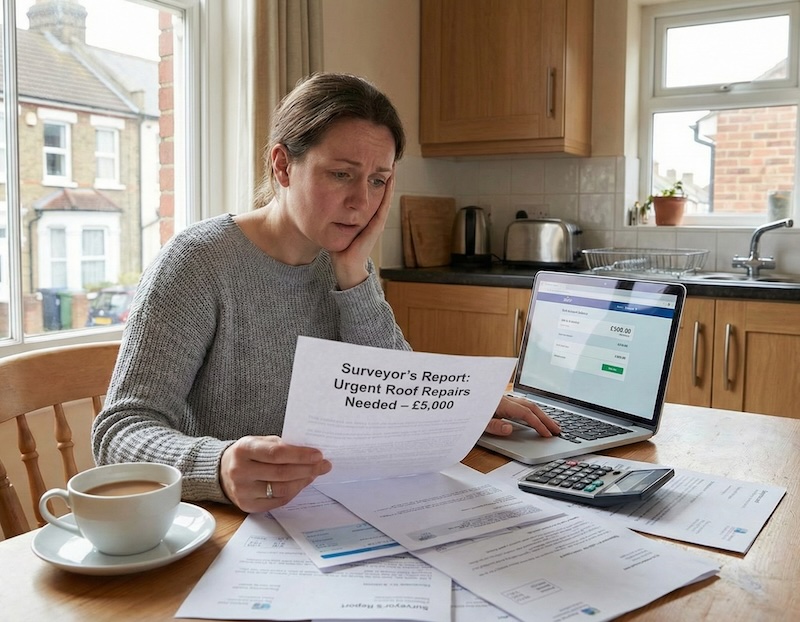

Surveyor Fees

A mortgage valuation is for the bank's benefit. A HomeBuyer's Report or Structural Survey is for your benefit, to check for damp, subsidence, or roof issues.

Lender Fees

Many mortgages come with an "Arrangement Fee" (often ~£995) to get a lower interest rate. This can sometimes be added to the mortgage, but you'll pay interest on it.

Crunch the Numbers for Your New Home

Monthly Repayments

Estimate your monthly mortgage payments.

Stamp Duty Calculator

Estimate the tax you may need to pay.

Affordability Check

Find out exactly how much you can borrow. For PAYEE/full-time workers.

Self-Employed Calculator

Find out exactly how much you can borrow as a self-employed or contractor.

Advanced Calculator

Equity & interest like a PRO.