How Long Does Mortgage In Principle Last: Everything Homebuyers Need To Know

Table of Contents

- TL;DR

- Understanding Mortgage In Principle Validity

- Typical timeframes

- Why the clock ticks

- What can shrink your window?

- How to keep it alive

- Factors That Influence a Mortgage In Principle Duration

- Credit score health

- Debt‑to‑income (DTI) ratio

- Employment stability and income verification

- Changes in the broader market

- How lenders handle expiries

- Quick checklist to protect your mortgage in principle

- Comparison of key factors

- How to Extend Your Mortgage In Principle

- Why an extension works

- Step‑by‑step checklist

- When to ask for an extension

- Extra breathing room and rate holds

- Common pitfalls to avoid

- Quick action list

- Common Mistakes That Shorten Mortgage in Principle Validity

- Making a new credit move

- Changing jobs or income

- Large cash withdrawals or deposits

- Ignoring interest‑rate shifts

- Skipping the 45‑day check‑in

- Actionable checklist to protect your mortgage in principle

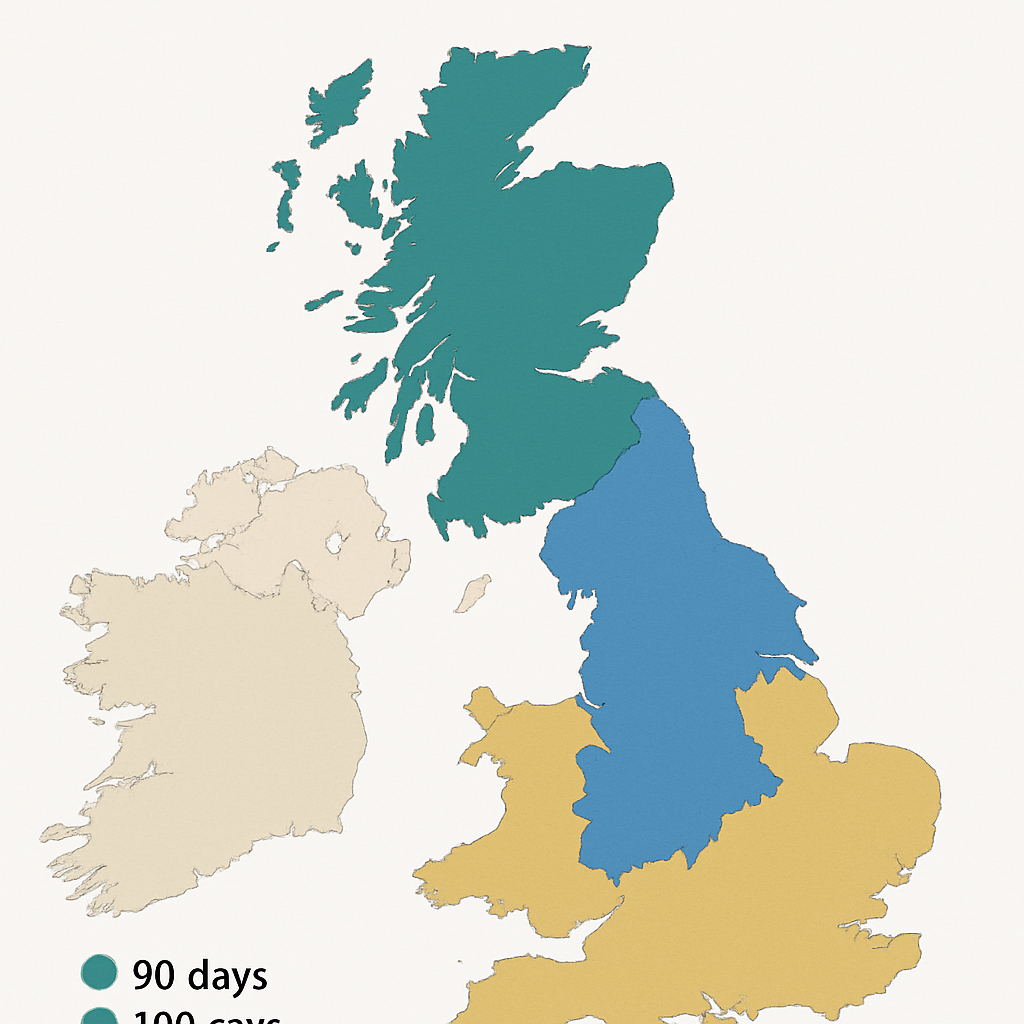

- State‑by‑State Variations in Mortgage in Principle Length

- England and Wales: the 60‑90 day sweet spot

- Scotland: a slightly longer horizon

- Northern Ireland: mixed approaches

- Why the variation matters for you

- When to Reapply for a New Mortgage in Principle

- Spot the ticking clock early

- When is a fresh mortgage in principle truly needed?

- Step‑by‑step re‑apply checklist

- What if you’re still within the original window?

- Special cases to watch

- Quick FAQ style tip box

- FAQ

- How long does mortgage in princple last in the UK?

- Can I extend the mortgage in principle if I’m not ready to buy yet?

- What happens if my credit score changes during the mortgage in principle period?

- Do I need to re‑apply if my income drops or I change jobs?

- Is there a difference in mortgage in principle length between England, Scotland and Northern Ireland?

- How often should I check in with my mortgage adviser while the mortgage in principle is active?

- Will I be charged extra for extending or re‑dating my mortgage in principle?

- Conclusion

Picture this: you’ve just found your dream terraced house in Birmingham, you’ve booked a viewing, and the seller asks for proof you can actually buy. That’s when a mortgage in principle (MIP) (or agreement in principle) appears in, giving you a great snapshot of what a lender thinks you can afford based on your income, credit score and finances.

But most UK mortgage in principle offers aren’t indefinite. Typically they stay valid for anywhere between 60 and 90 days. After that, the lender will want an updated affordability check, because your circumstances may have changed.

Why does this window matter? Because property markets move fast. A two‑month mortgage in principle can feel generous until you hear “offer accepted” and then realize the clock is ticking. If your approval expires while you are negotiating, you could lose momentum or even have to start the process all over.

So, what can you do to stretch that timeframe? First, lock in a mortgage in principle as early as possible, the sooner you have it, the more breathing room you get. Then, keep your financial picture stable while looking for a new home, avoid big purchases, new credit cards or changing jobs. And third, stay in touch with your mortgage advisor as they can often extend the validity if nothing major has changed.

Think about it this way: a mortgage in principle is like a reservation at a popular restaurant. It guarantees you a seat, but only if you show up before the reservation expires. If you dont get there on time you might end up waiting for the next opening.

Now that you’ve got the basics, let’s dive deeper into the exact timeline, what factors can shorten it, and how to keep your mortgage in principle alive until the keys are in your hand.

TL;DR

A mortgage in principle typically lasts between 60 and 90 days, giving you a window to find a home make an offer and lock in financing before the lender needs fresh affordability checks.

Keep your finances steady, avoid big purchases, and stay in touch with your advisor to extend or renew the approval, ensuring the reservation on your future home doesn’t expire before you turn the key.

Understanding Mortgage In Principle Validity

So you’ve got that shiny mortgage in principle (or agreement in principle) letter in hand and you’re wondering, how long does mortgage pre approval last? The short answer is most lenders give you a window of 60‑90 days which enough time to hunt, make an offer and get to the closing table, but not so long that your financial picture drifts too far.

Typical timeframes

According to Experian, the sweet spot is a 60‑ to 90‑day expiry, although a handful of lenders will issue a tighter 30‑day limit if they’re being extra cautious. That 90‑day mark is pretty standard across the UK, and it aligns with the life of most of the documents you hand over (bank statements, pay slips and the credit report itself).

Why the clock ticks

Think of mortgage in principle as a snapshot of your financial health. Lenders pull a hard credit inquiry, verify your income and assets, and then set a deadline because any change, like a new credit card, a job switch, even a sudden dip in your credit score could alter your ability to repay.

Mortgage Research points out that a 90‑day expiry also protects the lender from having to pull a fresh credit report right before closing, which could reveal a late payment or a medical collection that would otherwise jeopardise the deal (Mortgage Research explains).

What can shrink your window?

Beyond the calendar, a few real‑world events can force a premature refresh:

- Switching jobs or going part‑time.

- Taking on a new loan, credit card or car finance.

- Large withdrawals that dent your savings buffer.

- Any negative mark appearing on your credit file, like a medical collection.

If any of those happen, give your lender a heads‑up. Often they’ll simply ask for updated bank statements or a fresh pay‑stub, and you’ll get a new letter without re‑starting the whole application.

How to keep it alive

Here are a few no‑brainer habits to stretch that validity period:

- Lock in the mortgage in principle as close to the moment you start serious house hunting as possible.

- Keep your credit utilisation low avoiding big purchases on existing cards.

- Tell your mortgage advisor immediately if anything changes in your income or expenses.

- Consider a quick check‑in around the 45‑day mark; a brief phone call can secure a simple extension.

If you don't have a mortgage broker and need a mortgage in principle, you can find a mortgage broker near you who’ll walk you through the extension process and keep your paperwork tidy.

Another practical tip: use an affordability calculator while you’re in the hunt. It helps you visualise whether a new loan amount is still within reach, especially if interest rates shift.

Notice how the video walks you through the exact steps of checking your mortgage in principle expiry date on your lender’s portal. It’s worth a watch before you make that second offer on a property.

And remember, the mortgage in principle isn’t a guarantee, it’s a conditional green light. The final underwriting will still look at your most recent documents, but staying within that 60‑90 day sweet spot dramatically reduces the chance of a last‑minute surprise.

When the deadline looms, you have two choices: either rush the purchase or ask for a fresh mortgage in principle. The latter is usually quick, especially if your financial story hasn’t changed dramatically.

Factors That Influence a Mortgage In Principle Duration

Factors That Influence a Mortgage In Principle Duration

When you look at that mortgage in principle letter, it’s not just a date stamped on a piece of paper, it’s a reflection of the whole financial picture lenders see at that moment. A few key things can push that clock forward or pull it back, and knowing them helps you keep the timer on your side.

Credit score health

Think of your credit score as the first impression you make on a date. A solid three‑digit number (usually 670‑739 or higher) tells lenders you’re reliable. A good score not only improves your odds of getting approved, it can also extend the validity of the pre‑approval mortgage in principle because the lender feels less pressure to re‑check your credit soon after.

But if you let a credit card balance creep up or miss a payment, the lender may shorten the window, fearing a dip in your score before you close.

Debt‑to‑income (DTI) ratio

DTI is basically the balance between what’s coming in and what’s going out each month. A lower ratio (under 45 %) signals you can comfortably handle a mortgage payment on top of existing debts. When your DTI is tidy, lenders are happy to give you a longer breathing room.

On the flip side, adding a new loan, car finance, or even a big credit‑card purchase can spike that ratio, prompting the lender to ask for fresh paperwork sooner.

Employment stability and income verification

Stable employment is the backbone of any mortgage in principle agreement. Lenders will look at how long you’ve been with your current employer and whether your income is consistent. If you’re hopping jobs or going part‑time, the lender may feel the need to reassess sooner.

Self‑employment adds another layer as you might need to provide extra documents, and that can tighten the expiry date.

Changes in the broader market

Interest rates aren’t set in stone. When rates shift dramatically, lenders often refresh a mortgage in principle to make sure the loan amount you were approved for still makes sense under the new cost of borrowing.

That’s why you sometimes hear advisors suggest “checking in” around the 45‑day mark as it’s a quick way to lock in the same rate or get a good extension without starting from scratch.

How lenders handle expiries

If your mortgage in principle is about to run out, the good news is you don’t have to start over. Usually a fresh set of bank statements or a quick employment verification can earn you a new letter with a fresh expiry date. Get an updated mortgage in principle online here.

That extra step is often painless, especially if nothing major has changed in your financial story.

Quick checklist to protect your mortgage in principle

- Keep credit utilisation under 30 % and avoid new credit lines.

- Maintain a steady DTI and pause large purchases until after you close.

- Stay with the same employer, or if you must change, inform your loan officer immediately.

- Monitor interest‑rate news and schedule a 45‑day “status check” with your advisor.

And remember, the mortgage in principle is a tool, not a guarantee. Treat it like a reservation at your favourite restaurant that you still need to show up on time, but a little heads‑up to the staff can keep your table waiting.

Comparison of key factors

| FactorHow it Affects DurationTypical Impact | ||

| Credit Score | Higher scores signal lower risk, so lenders may allow a longer window. | Extension up to 15‑30 days. |

| Debt‑to‑Income Ratio | Low DTI shows capacity to handle extra debt, keeping the mortgage in principle stable. | Fewer requests for updated statements. |

| Employment Changes | Job switches or reduced hours raise red flags, prompting earlier re‑verification. | Potential reduction of expiry by 10‑20 days. |

How to Extend Your Mortgage In Principle

So you’ve hit that 60‑day mark and the clock’s ticking. You’re probably thinking, “Do I need to start the whole thing over?” The good news is, most lenders will let you stretch the expiry with a quick update, no drama, just a few fresh documents.

Why an extension works

Think of your mortgage in principle as a snapshot of your financial health. As long as the picture hasn’t changed dramatically, the lender can simply re‑date the snapshot. That’s why a fresh set of bank statements or a short employment verification often does the trick. Guild Mortgage already mentioned this painless step, and the same logic applies across the board.

Step‑by‑step checklist

1. Spot the window early. Mark the expiry date on your phone calendar and set a reminder 10‑15 days before it runs out. This gives you time to gather anything you might need.

2. Gather the basics. Usually the lender asks for:

- Latest two months of bank statements.

- Most recent payslip or a letter confirming you’re still in the same role.

- A quick credit‑check update if your score has moved.

That’s it, no need to redo the whole affordability test unless something big has changed.

3. Call your mortgage advisor. A quick 5‑minute phone call works wonders. Explain that you’re still on the same financial track and ask if they can “extend the mortgage in principle”. Most advisors will email you a new letter within a day.

4. Confirm the new expiry. Once you get the updated letter, double‑check the new date. Some lenders automatically add 30‑45 days; others might match the original 90‑day window.

When to ask for an extension

If you’re still house‑hunting but the market is moving slowly, request an extension as soon as you see the deadline approaching. If you’ve already found a property but need a little extra time to lock in a rate, let your adviser know as they can often hold the rate while they refresh the paperwork.

Extra breathing room and rate holds

Some lenders go a step further and lock your interest rate for a set period even after the mortgage in principle expires. Some lenders will hold your rate for up to 120 days subject to conditions, not only of your circumstances but market conditions as rates can go up and down at any time.

Common pitfalls to avoid

Don’t wait until the last minute to ask for an extension as lenders need time to run the quick checks. Also, avoid any big financial moves (like a new credit card or a major purchase) right before you request the extension; even a small change can make the lender ask for a full re‑assessment.

Finally, keep your DTI and credit utilisation low. A sudden spike in either can erase the easy extension and force you back to square one.

Quick action list

- Set a reminder 10 days before expiry.

- Collect two months of statements and a recent payslip.

- Call your advisor and ask for a “mortgage in principle extension”.

- Check the new expiry date and rate‑hold terms.

- Avoid new credit or large purchases until you close.

By treating the extension as a simple check‑in rather than a whole new application, you keep the process smooth, the stress low, and your home‑buying timeline on track.

Common Mistakes That Shorten Mortgage in Principle Validity

So you’ve got that shiny mortgage in principle letter and you’re already dreaming about the perfect front‑door. But the clock is ticking, and a few easy‑to‑miss missteps can shave days, or even weeks, off that window.

Making a new credit move

One of the fastest ways to invalidate your mortgage in principle is opening a fresh credit card or taking out a personal loan. Lenders see any new hard inquiry as a potential shift in your debt‑to‑income ratio, and they’ll often ask for a full re‑assessment.

Imagine you’re scrolling through a new “Buy Now, Pay Later” offer and think, “It’ll be harmless.” A month later you’ve added a £2,000 line, your credit utilisation jumps, and your lender suddenly asks for fresh bank statements. That extra paperwork can eat up 10‑15 days of your mortgage in principle period.

Changing jobs or income

Switching roles, especially from full‑time to part‑time, or taking a gig‑economy job looks great on a resume but scares lenders. They need to verify that your new income stream is stable, which usually means a fresh employment verification and possibly a new income‑assessment. Even a promotion that bumps your salary can trigger a review if the lender’s system flags a “change in compensation.”

Real‑world example: Sarah was offered a higher‑paying position in Manchester three weeks after her mortgage in principle was issued. She told her advisor, thinking a raise was a win‑win. The lender asked for a new payslip, a tax‑year statement, and a revised DTI calculation. By the time the paperwork cleared, her original 90‑day window had slipped to 65 days, forcing her to request an extension.

Large cash withdrawals or deposits

Suddenly moving £10,000 into a savings account to boost your down‑payment sounds smart, until the lender spots the influx and wonders where the money came from. They’ll request a source‑of‑funds letter, and that back‑and‑forth can take several days. Conversely, a hefty withdrawal for a car purchase or home‑renovation can raise red flags about your remaining buffer.

John and Emma withdrew £5,000 to pay off a car loan after their mortgage in principle was issued. The lender put their file on hold, asking for a revised bank statement and an explanation. The delay ate into their pre‑approval validity, and they had to rush the property offer.

Ignoring interest‑rate shifts

When the Bank of England tweaks the base rate, lenders often adjust the loan amount they’re comfortable offering. If you wait until the last minute to lock in your rate, you might find the mortgage in principle amount no longer covers the property you love. Staying informed about rate movements and discussing a rate‑hold with your advisor can safeguard your timeframe.

Skipping the 45‑day check‑in

Many lenders are happy to give a quick status call around the halfway mark. It’s a painless way to confirm that nothing major has changed and, in some cases, to add an extra 30‑45 days automatically. Skipping this step means you’re flying blind until the expiry date hits.

Actionable checklist to protect your mortgage in principle

- Put a calendar reminder for 45 days after issuance; call your advisor for a “status check.”

- Avoid opening new credit accounts, even promotional ones, until the mortgage is sealed.

- If you’re considering a job change, discuss it with your lender first; they may advise a temporary hold.

- Keep large cash movements to a minimum; if you must deposit or withdraw, have documentation ready.

- Monitor interest‑rate news and ask about rate‑hold options early in the process.

State‑by‑State Variations in Mortgage in Principle Length

You’ve seen the 60‑90 day rule in the previous sections. But did you ever wonder why a friend in Manchester seems to have a 30‑day window while your cousin in Cornwall gets a full 90 days?

It’s not magic. Different lenders (sometimes different parts of the UK) set their own expiry dates based on risk appetites, local market speed and regulatory nuances. In other words, the “how long does mortgage in principle last” answer can shift depending on where you are.

England and Wales: the 60‑90 day sweet spot

Most high‑street banks and building societies in England and Wales stick to the classic 60‑to‑90‑day range. They base this on the shelf‑life of the documents you handed over – payslips, bank statements and that hard credit pull. If you’re looking at a fast‑moving market like London, some lenders even shave it down to 45 days to protect themselves against rapid price swings.

Think about it like this: a lender in Manchester might say, “We’ll give you 90 days because the local market moves a bit slower, giving us confidence the numbers you showed us won’t change dramatically.” That extra cushion can be a lifesaver if you’re juggling a chain or waiting on a survey.

Scotland: a slightly longer horizon

In Scotland, a few mortgage providers extend the principle window to 120 days. The reason? Scottish property transactions often involve a longer legal process, especially with the “title registration” steps that can add weeks. Lenders adjust the expiry to match that timeline, so you don’t suddenly find yourself scrambling for fresh paperwork right before the completion date.

One practical tip: if you’re buying in Edinburgh or Glasgow, ask your advisor early whether the lender offers a “Scottish extension”. It’s a small question that can save you a lot of stress later.

Northern Ireland: mixed approaches

Up north the picture is a bit patchier. Some lenders mirror the England‑and‑Wales 60‑day rule, while others, particularly regional building societies, give you the full 90 days. Because the market can be both hot in Belfast and quiet in rural counties, you’ll often hear advice like “keep an eye on your expiry and book a 45‑day check‑in just in case.”

That check‑in isn’t just a courtesy call – it’s a chance to lock in a rate hold or snag an automatic extension without re‑filing the whole application.

Why the variation matters for you

Imagine you’ve found the perfect flat in Leeds, but your mortgage in principle is set to expire in 30 days. If your lender follows a tighter policy, you might need to rush the offer, potentially overlooking hidden costs. Conversely, if you’re in Scotland with a 120‑day window, you have room to negotiate, get a survey, and still keep your MIP intact.

So, what should you do? First, check the expiry date on your letter – it’s usually in bold at the top. Then, ask your mortgage adviser: “Do you offer a rate‑hold or an extension for my region?” Most will say yes, but they’ll want confirmation that nothing major has changed in your financial picture.

And remember that the clock can still tick faster if you make a big purchase, switch jobs, or if interest rates jump. Even a 120‑day mortgage in principle can evaporate in a week if your DTI spikes.

Bottom line? The “one‑size‑fits‑all” 60‑90 day rule is more of a guideline than a law. Your local market tempo and the lender’s risk model shape the exact length. Knowing the regional quirks lets you plan your house‑hunt with confidence, not anxiety.

For a quick reference, here’s a cheat‑sheet:

- England & Wales: 60‑90 days (sometimes 45 in fast markets)

- Scotland: up to 120 days for many lenders

- Northern Ireland: 60‑90 days, check for lender‑specific extensions

Keep this list handy, set a calendar reminder for the midway point, and give your adviser a call. A short chat can turn a looming expiry into a smooth extension.

Want to visualise the differences?

And if you ever need a local expert to walk you through the extension process, just reach out – a quick conversation can make the whole thing feel as easy as a coffee break.

According to Regions Bank, mortgage in principle periods typically range from 30 to 90 days depending on the lender’s policy, reinforcing that the exact length really does depend on who’s issuing the letter and where you’re buying.

When to Reapply for a New Mortgage in Principle

We've walked through how long the original mortgage in principle typically sticks around. But life rarely pauses at day 60, right? If your deadline is looming and you still haven't found “the one,” it's time to think about re‑applying.

Spot the ticking clock early

First thing you should do is glance at the expiry date as soon as you get the letter. Mark it in your phone, set a reminder for the halfway point – usually around day 30‑35 – and treat that reminder like a coffee date with yourself.

Why the halfway check? Because most lenders are happy to give a quick extension if nothing major has changed. A simple call before the date can save you a frantic scramble later.

When is a fresh mortgage in principle truly needed?

If any of these red flags pop up, start the re‑application process right away:

- You’ve switched jobs or taken a significant pay cut.

- Your debt‑to‑income ratio has jumped due to a new loan, credit card, or large purchase.

- Interest rates have moved enough that the loan amount you were approved for no longer covers your target price.

- You’ve had a credit‑score dip from a missed payment or a new hard inquiry.

Each of those changes tells the lender your financial snapshot is no longer accurate, and a fresh mortgage in principle will reflect the new reality.

Step‑by‑step re‑apply checklist

- Check the original expiry. If you’re within 10‑15 days, pick up the phone.

- Gather updated documents. Two months of bank statements, your latest payslip, and any new proof of assets.

- Update your credit check. A quick soft pull (your advisor can do this) confirms you’re still in the same credit band.

- Ask about a rate‑hold. Some lenders will lock the interest rate for another 30‑45 days while they re‑date your mortgage in principle.

- Confirm the new expiry date. Get the fresh letter in email or post and double‑check the calendar.

Sound familiar? It’s basically the same routine you followed the first time, just with a tighter timeline.

What if you’re still within the original window?

Good news: you don’t always need a brand‑new letter. Many UK lenders will simply “re‑date” the existing mortgage in principle as they pull a fresh credit snapshot and slap a new expiry on the same document.

All you have to do is let your mortgage adviser know you’re still hunting and ask if a “re‑date” is possible. It’s usually a matter of minutes, not days.

Special cases to watch

First‑time buyers in fast‑moving markets like London often feel the pressure to act before the 45‑day mark. If you’re in that situation, consider requesting an early extension even if nothing has changed. The extra buffer can be the difference between snagging a deal and watching it slip away.

Buyers on a chain should also be proactive. If the property you’re waiting on is delayed, let your lender know as soon as you get word. A short conversation can secure an extra 30‑day hold without any paperwork.

Quick FAQ style tip box

How many times can I re‑apply? There’s no hard limit, but each fresh check adds a hard credit inquiry. Keep extensions to a minimum to protect your score.

Will the loan amount change? It can, especially if rates have moved or your income has shifted. Be ready to adjust your price range.

Do I pay extra? Most lenders waive fees for a simple re‑date, but a full new mortgage in princple might carry a small administrative charge.

Bottom line: treat the expiry date as a friendly nudge, not a death sentence. By staying ahead of the clock, keeping your paperwork tidy, and having that quick chat with your adviser, you’ll keep the mortgage engine humming right up to the day you sign the contracts.

FAQ

How long does mortgage in princple last in the UK?

Most lenders give you a 60‑ to 90‑day window from the day they issue the letter. That period is long enough to hunt for a property, make an offer and get the paperwork moving, but short enough that your financial picture stays fresh. If the clock runs out before you’re under contract, you’ll usually need a quick update or a brand‑new mortgage in princple.

Can I extend the mortgage in principle if I’m not ready to buy yet?

A lot of advisors will add 30‑45 days with a simple “status check.” All they need is a recent bank statement and a confirmation that nothing major has changed in your income or debt. It’s a painless phone call, not a full re‑application, so you keep the same loan‑to‑value ratio and any rate‑hold you’ve already secured.

What happens if my credit score changes during the mortgage in principle period?

Any dip in your score can make the lender nervous, because the original risk assessment is no longer accurate. They’ll typically ask for an updated credit pull and might tighten the loan amount or shorten the expiry date. To avoid surprises, keep credit utilisation low, don’t open new cards, and check your score a couple of times before the halfway mark.

Do I need to re‑apply if my income drops or I change jobs?

If you switch to a lower‑paying role or go part‑time, the lender will want fresh proof of earnings. That usually means a new payslip, a short employment‑verification letter, and a recalculated debt‑to‑income ratio. In most cases you can get a “re‑date” on the existing mortgage in principle rather than starting from scratch, but the new figures will dictate whether the original loan amount still fits.

Is there a difference in mortgage in principle length between England, Scotland and Northern Ireland?

England and Wales typically stick to the 60‑90‑day sweet spot, though fast‑moving markets like London sometimes shrink it to 45 days. Scotland often stretches the window to 120 days because the legal process can take longer. Northern Ireland is a mix: some lenders mirror England’s 60‑90 days, others offer a bit more flexibility, so it’s worth asking your adviser about regional nuances.

How often should I check in with my mortgage adviser while the mortgage in principle is active?

A quick catch‑up around the 45‑day mark is a good habit. It gives you a chance to confirm that nothing major has shifted, lock in a rate‑hold if you need more time, and request a simple extension before the original expiry. A brief call or email usually takes five minutes and can save you days of frantic paperwork later on.

Will I be charged extra for extending or re‑dating my mortgage in principle?

Most lenders waive fees for a straightforward extension or re‑date, especially if your financial situation is unchanged. However, if they need a full new affordability assessment, for example, after a job change or a credit‑score dip. A small administrative charge may apply. It’s always worth asking up front so there are no surprise costs when you ask for the extra time.

Conclusion

We've walked through why most UK lenders give you a 60‑90 day window, how regional quirks can stretch or shrink that period, and the simple habits that keep your mortgage in principle alive.

So, what does that mean for you? It means treating the expiry date like a friendly reminder rather than a deadline you dread. Set a calendar alert, do a quick 45‑day check‑in with your adviser, and avoid any big credit moves until your offer is sealed.

Remember, a mortgage in principle is a snapshot, as long as the picture stays the same, extending it is usually a five‑minute phone call. Whether you're in bustling London, historic Edinburgh, or a quiet town in the Midlands, the same principle applies: stay steady, stay informed, and let your mortgage advisor handle the paperwork.

If you ever feel the clock ticking faster than you’d like, reach out to a Mortgage Mapper adviser. They’ll walk you through a painless extension or re‑date, so you can keep focusing on finding the right home.

Bottom line: keep your finances steady, check in early, and you’ll keep that mortgage in principle (MIP) window comfortably open until you’re ready to sign.

![What Is The Minimum Down Payment (Deposit) For A House In The Uk? [2026][Short Version]](https://mortgagemapper.com/featured-images/what-is-the-minimum-down-payment-deposit-for-a-house-in-the-uk-2026-short-version.jpg)